🕓 10 min Read

● Accounting activities, such as collecting and processing payroll, taxes, and payments, are frequently demanding – it’s no surprise that the term “taxation” denotes “difficult or requiring a lot of thinking or work.”

● In reality, if you make specific accounting mistakes while processing payroll or taxes, you will most certainly run into difficulties with your government, jeopardizing the future validity of your entire organization.

● The same is true for bookkeepers and accountants: if you make a mistake in your calculations or document preparation, you will annoy your clients and harm your reputation as a trustworthy expert.

● And it is at this point that accounting technologies appear as potential answers to your accounting problems. There is a lot of company accounting software on the market these days, but only a few of them meet the demands of the customers in an easy way. A slew of software has appeared in recent years, making it difficult for industry giants like Tally to compete.

● Businesses are beginning to favor online applications owing to a variety of advantages such as anywhere access, automatic backup, and so on. If you are still unsure which is better for you, check our guide – Accounting Software vs. Online Accounting Application.

● Small firms often need the entry of simple transactions as well as the compilation of some basic reports. They do not need to have a sophisticated ERP system. Their goal is to understand their selling, buy, and cash balances, as well as to fulfill their legal procedures.

Whether It’s A Software Development Consulting, Custom Software Development Or Cloud Applications, We Have The Right Solution For Your Business. Contact Us Today To Learn More About How We Can Help You Succeed

● When a company’s bank accounts and credit cards are synchronized with its accounting software, transactions appear in a queue and may be sorted into the categories listed on the chart of accounts. After selecting the appropriate category, transactions begin to populate the financial accounts of the company. A financial report may be generated in seconds for business owners to analyze profitability, compare income and costs, monitor bank and loan balances, and forecast tax liabilities. Having immediate access to this financial information empowers business leaders to make critical decisions.

● Furthermore, many accounting software packages allow for the integration of third-party applications. For example, if a business owner employs a point of sale (POS) system to collect sales transactions, the POS system may be able to link with accounting software to record particular transactions, sales tax obligations, sales by subcategory, and other information. A time tracking programme might be integrated with accounting software in a service-based firm to add labor to a customer invoice.

Before deciding on our top five software solutions, we researched nineteen accounting software vendors that offer specialized products for small businesses. Cost, scalability, simplicity of use, reputation, and accounting functionality were all factors evaluated. Reputation was an essential aspect since the longer a firm has been in business, the more likely that any technology issues have been rectified, ensuring that a company’s critical financial information is presented honestly. The second most significant factor was scalability, because as a company expands, so do its accounting demands, and moving financial data to new software may be time-consuming. Finally, simplicity of use and cooperation for business owners, workers, and accountants were taken into mind because it is critical for all users to be able to access and examine financials at the same time.

● Accounting software allows customers to connect their corporate bank accounts and credit cards with the programme, which decreases the amount of time spent on data entry. Transactions will go into the accounting software when they have been synchronized, where they may be classified into various accounts. While most accounting software is simple to use, a basic grasp of accounting concepts is required to guarantee that financial reports are appropriately created. For this very reason, many businesses hire bookkeepers or accountants to maintain or review their books. Cloud-based online accounting software makes it convenient for companies and businesses to access their books at the same time as their bookkeeper or accountant.

● Accounting software for small enterprises has the following fundamental functions:

Invoicing

Syncing of bank accounts

and credit cards

Accounts receivable

Customer payment collection

using the internet

Preparation of basic financial

accounts, such as profit and

loss statement

Accountants and tax experts

have access to the system

● Furthermore, studies reveal that firms that do their financial reports on a weekly and monthly basis have a far lower success rate than organizations that use automated accounting software. Furthermore, according to a Statista study, around 64% of organizations employ accounting technology. Accounts Payable automation (i.e. AP automation) is the technology used to handle different financial and accounting operations — and one infographic illustrates that AP automation solutions may save you at least 16$ each invoice.

The goal of cost accounting is to document a company’s entire production costs. It calculates the fixed and variable costs of a company’s production phases. It is a way of accounting in which the expenses of carrying out any project, operation, or product are documented and analyzed. The examination of a company’s overall production cost assists management in making strategic decisions. Material, labor, and other expenses are among the costs included in cost accounting.

Financial accounting is the process of recording, summarizing, and reporting financial transactions resulting from company operations for a specific period. Accounts, such as the statement of income, balance sheet, and cash flow statement, are prepared using such transactions. They represent the company’s financial results for a specific time period.

Management accounting is a discipline of accounting in which the organization’s management uses financial data to create strategic plans and choices for future business requirements. The information obtained under management accounting includes information from all areas of accounting as well as all business functions. It is useful for making critical decisions in highly competitive firms, particularly those involving cash flows, sales, budgeting, and investments

Tax accounting specifies the exact regulations of various tax laws that assesses, such as people and organizations, must follow while filing their tax returns. Tax accounting focuses on taxes rather than company yearly financial statements. It refers to the procedure of accounting for tax reasons. This accounting method aims to make it easier to track monies (inflows and outflows) associated with companies and people.

Management accounting is a discipline of accounting in which the organization’s management uses financial data to create strategic plans and choices for future business requirements. The information obtained under management accounting includes information from all areas of accounting as well as all business functions. It is useful for making critical decisions in highly competitive firms, particularly those involving cash flows, sales, budgeting, and investments

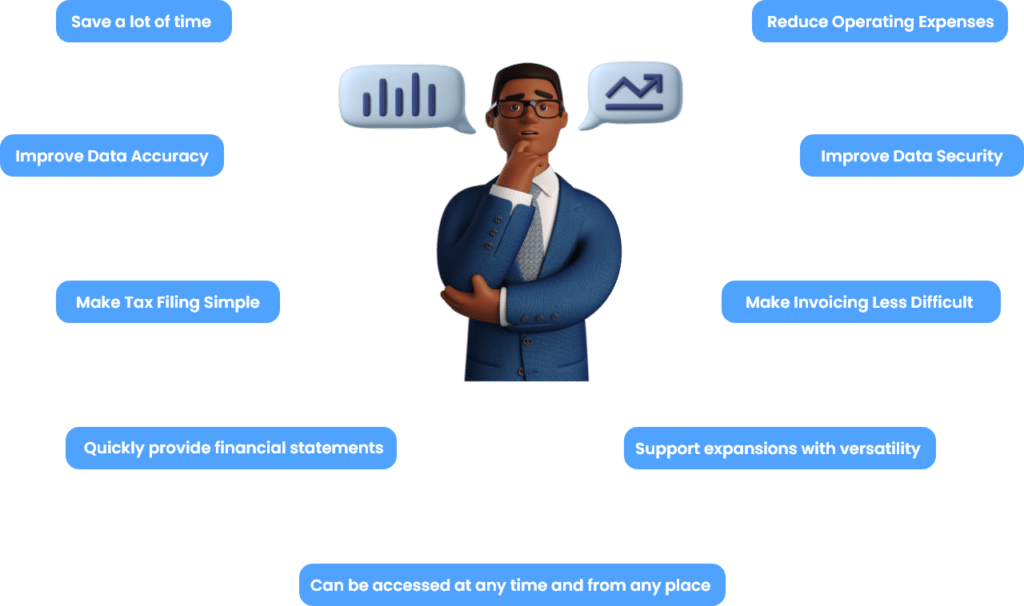

● Accounting is one of the most time-consuming, repetitive, and tiresome responsibilities in any firm. It is also the most important aspect of the business. However, the majority of accountants today believe that traditional accounting is no longer sufficient to keep them competitive.

● This is when accounting software comes into play. They make the accounts department’s job easier, faster, and smoother, providing them more time to focus on the financial and accounting decision-making components.

● This is most likely why more than 64% of SMBs use accounting software in their business. But that’s not all. There are several ways in which an accounting tool might benefit your company.

The most significant advantage of accounting tools is that they save a significant amount of time. The accounting system speeds up most accounting activities, such as invoicing, statements, reporting, and budgeting. Furthermore, the accounting application can automatically capture the majority of the data you would typically review and enter. For example, when your employee submits an expense claim, it is instantly synced with your accounting software. As a result, what used to take days to hand input everything (money, documentation, and other required information) may now be done in minutes.

● Accounting tools demand an initial investment, but can save you a lot of money in the long term. Accounting software eliminates the need to hire a bookkeeper or bill for the extra time spent checking the correctness of your accounts.

● As previously stated, an accounting system decreases the amount of time necessary for data input, allowing your finance staff to spend more time reviewing business performance.

● Another method an accounting programme might help you save money is by simplifying your financial flow. It gives you a bird’s-eye view of your payables and receivables, so you know where your money is actually going.

● Don’t we all make mistakes? The same is true for accountants. And, while mistakes are normal, they may be quite costly to your firm. Hertz, a vehicle rental firm, discovered some $46.3 million in accounting irregularities in 2011. In another state of affairs, Groupon lost roughly $22 million in 2012 because of money errors.

● These mistakes may be considerably reduced with an accounting automation system. Even if your finance statement’s computations are complex and long, a decent accounting instrument will not fail you down. The only thing you need to be sure of is that the data you enter into the tool is valid.

Profit and loss accounts, balance sheets, and cash flow statements are essential components of every organization. They assist you in understanding your organization’s present financial status. Without an accounting system, your finance staff would have to go through dozens of files to find (or analyze) a document. And, if they are out of date, you will have to wait hours (if not days) to obtain the necessary statement. Accounting software, on the other hand, enables you to generate financial reports in minutes. All you have to do is choose a date and click “generate the report.”

● One of the most hated tasks for everyone in the accounting department is income tax filing. With so many regulations and provisions to follow, it’s easy to become overwhelmed.

● However, this should not be used as an excuse to make mistakes in tax filing. Even a tiny blunder might result in a hefty fine for your company. Accounting software makes tax preparation much easier.

● It can help you manage all of your receipts and invoices so that tax compliance and filing go more smoothly. Some advanced accounting software can structure invoices automatically, making accountants’ jobs easier during tax season.

As you digitize your business operations, you’ll need solutions that operate together. Consider using separate tools to make your task easier that do not communicate with one another. That does not appear to be a simple task. Most current accounting software, on the other hand, interacts with your existing company apps. This implies that your accounting system receives data from HR software, expenditure management software, and other sources. As a consequence, there will never be duplicate entries and you will have real-time data across all platforms.

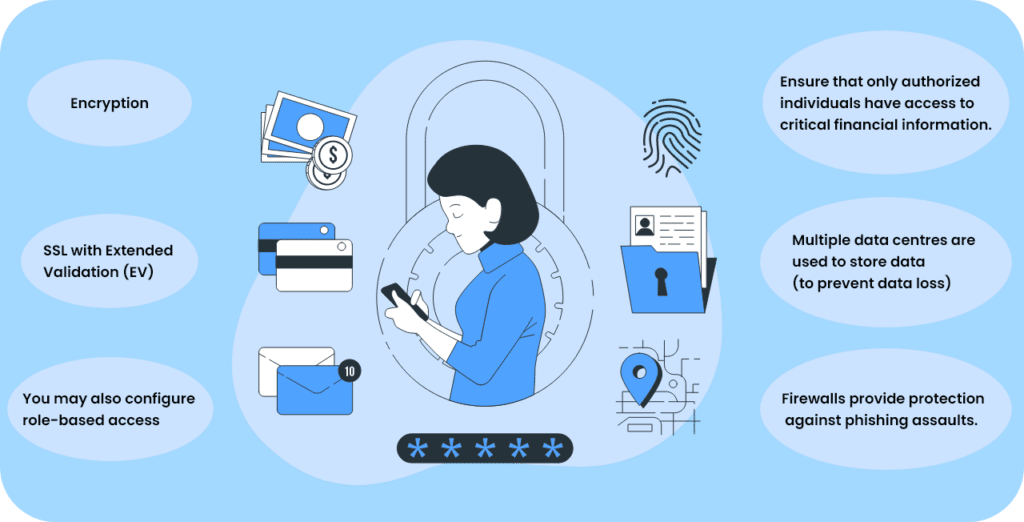

With the increase in cyberattacks, data security is more vital than ever. In 2020 alone, there were more than 445 million cyberattacks, more than quadruple the number in 2019. Extra security layers, such as two-factor authentication, allowed access, and frequent backup, are used to safeguard today’s online accounting software. Advanced businesses will even employ extra security procedures to safeguard your data, such as:

Using a cloud-based accounting programme allows you to operate from any location. You can get your financial data from anywhere and at any time. All you’ll need is a gadget that can connect to the internet.This is ideal for decision-makers who frequently travel for work. You will be able to execute a payment, review a document, generate financial reports, and more without ever having to come into the office. However, ensure that the accounting tool you select includes a mobile app so that you can securely log in and access data as needed.

Invoicing is a time-consuming and difficult procedure. And, if done hastily, the likelihood of mistakes is significant. Accounting software, on the other hand, allows you to make digital invoices in minutes. The accounting system will generate the invoice based on the previously recorded data. All you have to do is input the date and the party’s information. And the tool will take care of the rest of the things. This is incredibly useful since it enables you to give reports to clients promptly (without making them wait for the complete payment information), resulting in improved customer satisfaction.

Your accounts will expand in tandem with your company. From recruiting additional employees to onboarding clients, there is a lot that goes into growing operations. To maintain the traditional bookkeeping approach, you will need to hire additional accountants. With an online accounting system, however, all you need to do is increase your package. You won’t have to deal with the trouble of obtaining new software or employing accountants. Not only that, but You can even reduce your plan if necessary. This independence enables you to keep your company functioning smoothly.

Accounts payable

Various Options for reporting

Accounts Reconciliation

Payroll

The accounts payable process is the process of paying suppliers for the goods and services they have provided. The process starts when a supplier sends an invoice to a company. This invoice will contain information about the goods or services that were purchased and the price that was paid for them. The company then needs to check this information against their records before they can make a decision on whether or not to pay the invoice. Nobody enjoys paying bills, but it is necessary for any business to maintain track of what they owe. Your accounting system may handle the outflow side of your cash differently. Here are some of the A/R characteristics that you should look for when finding a great Accounting software or application.

Accounting software handles your purchases and what you owe, but how it works varies, from issuing basic purchase orders to tracking quotations all the way through to purchasing and payment. A purchase order is an order given by a company to a vendor to supply materials, goods, or services. It is often used when the company does not want to wait for the vendor to send an invoice and instead wants to pay for the goods before they are delivered.

Many A/P modules can totally automate your payment procedures, from arranging bank transactions and direct deposits to generating checks, guaranteeing you don't fall behind. The Accounts payable app automatically pays invoices as they are approved. This means that you can approve an invoice and it will be paid without any more interaction required on your part.

Accounting software should, at the least, be linked to your bank account, that allows you to make direct payments and integrate real-time data from the banks into the accounting software. Some software can go a long way. The new feature will allow you to link your bank account to your accounting app. This is a great way to make sure that your finances are always in order and that you are not missing any transactions. The form will ask for the bank name, account number, and all the details required to link your bank account. This information is all required in order to properly link an account.

It's easy for a company to lose focus of all the credits that vendors frequently give out as incentives or refunds. Credit memos, on the other hand, are as precious as cash, so a software that can monitor them helps keep expenses down. It will allow vendors to submit invoices for payment that have been previously sent but not paid. This feature will help organizations capture revenue from unpaid invoices faster, and in turn, reduce the number of outstanding invoices at any given time. More and more companies are using automatic payments. It is a way to make the payment process easier and faster.

A database of the most frequent tax forms, such as the 1099 and 1096, may save you a significant amount of time. This is particularly true if your accounting software can fill out the papers for you and electronically file them with the IRS. This way you will be able to avoid penalties for late payments by paying your taxes electronically and completing forms. The IRS forms feature in Accounts payable app is great for businesses that need to file their taxes. It gives them access to all the forms they need and it also provides them with step-by-step instructions on how to fill out the forms. This will help in saving a lot of time and hence, reduce errors.

Payroll modules in some accounting systems are quite complex, delivering comprehensive payroll services that perform all from computing hours and processing paychecks to paying payroll taxes and making 401(k) contributions. Here are some of the greatest accounting software payroll features.

● Whether your workers are salaried or hourly, a system that can compute what you owe them is critical. When you have a large number of part-time or intermittent personnel, problems occur. Some workers may be paid every month, while others may be paid weekly, bimonthly, or as required. Your software should be able to manage various pay schedules, as well as various forms of remuneration (commissions, wages, profit sharing, bonuses, and so on) and benefits (mediclaim benefits, retirement plans etc).

● Employees should know how much they will be getting paid and what they will get in return. The variable wage schedule feature will help them have a more accurate idea of their earnings so they can plan accordingly. It can be used to incentivize employees to work harder or as a way to reward them for their good performance.

● Accounting software must enable this feature these days, as most consumers want their wages to be transferred straight into their bank accounts. You should be able to set up regular direct deposit payments using decent accounting software.

● The direct deposit schedule feature on the accounts payable app is a powerful tool that enables accountants to manage their client’s monthly payroll. It will be an indispensable tool for any accountant handling payrolls.

This includes everything from managing merely the most basic deductions to giving intricate tax tables and printing necessary documents. Determine whether or whether the system allows new-hire reporting, expenditure tracking, W-4s, and W-9s. Is it in charge of monthly federal tax payments as well as quarterly federal tax returns such as Form 941? Does it handle yearly reports and returns like the W-2, W-3, Form 940, and 1099? Will it prepare state income tax and unemployment insurance returns? This is a feature that automatically calculates the taxes owed on a purchase, based on the customer’s address. The tax calculation feature is an important addition to the app because it makes it easier for businesses to comply with tax law and avoid penalties.

If your workers incur tax-deductible costs, such as travel and entertainment, you’ll need a system that can manage these reimbursements while also ensuring that payments are made on time. This feature helps the users to track their expenses and submit them in an easy way. The best part about this feature is that it not only allows the employees to submit their expenses but also allows the managers or supervisors to approve or disapprove those expenses.

If you have many bank accounts, software that can track and reconcile them all is crucial. Ascertain that your application provides a general ledger feature as well as cheque book reconciliation.

If you make a lot of payments via cheques, a system that can print and handle them will save you a lot of time. Other things to look for are check voiding and notice of duplicate check payment. This feature allows users to deposit cheques, withdraw funds from their accounts, and pay bills using their phone.

An accounting product that cannot manage the establishment of simple electronic deposits is unheard of these days, but you should inquire about the types of digital payments it can handle.

It also eliminates human error in reconciling deposits, which has been a problem for many years.

Reports in accounting apps can provide a lot of insights into how your business is performing. Reports provide information on a specific time period, such as weekly or monthly. They can also be broken down by category, such as revenue or expenses. The beauty of these reports is that they are generated automatically and provide you with real-time statistics on your business.

The accounting system should be able to create standard company reports such as financial statements (profit and loss), balance sheets (assets and liabilities), cash flow statements, accounts receivable, accounts payable, and payroll summary. Standard reports are a feature in an accounting app that helps business owners to get a clear overview of their finances. These reports can be generated as PDF, Excel sheet, or CSV.

You can build and assemble any report you want using a system that provides for configurable reporting settings. Look for a software that allows you to simply add or delete columns from basic reports, modify column widths, and save bespoke reports so that they may be duplicated in the future. You can also use this feature to generate a report for a specific time period, set up filters and customize the data that you want to see in the report.

Long lists of statistics can be difficult to read, but software that can convert data into graphical representations, such as pie and bar charts, can assist you in making sense of where your money goes. Look for color-coding and the flexibility to display past years on the same graph for comparative purposes.Graph summaries is a new feature in accounting apps that allows users to visualize their financial data in a clean and user-friendly way.The graph summaries are designed with the intention of making it easier for the user to understand their data. The graphs show daily, monthly, and yearly totals for each category with a clear breakdown of where the money has gone.

Reports are useful for identifying patterns, but a software that can evaluate data, do statistical analysis, and provide projections may help you make monetary decisions

If you own many firms, a system that can combine some financial features might provide a more comprehensive view of your complete portfolio than relying on separate reports. Affiliate/subsidiary reporting is a feature that allows you to see the financials of your company and its subsidiaries in one place.

Online accounting software can also handle procedures that go well beyond financial administration, allowing you to govern practically every area of your organization from a single platform. If you believe the following advanced features will help you operate your business, keep an eye out for them:

Printing shipping

labels

Estimates

Job Status

Printing shipping

labels

Estimates

Job Status

By printing labels with orders or invoices, you may save a lot of time and expedite the shipping process. With this feature, it is easier for businesses to ship their products because all the information is already there.

Some systems can be programmed to recognise changes in weight and distance in order to offer accurate estimates of the shipping cost. This also guarantees that such charges are included in your final billings and pricing. To estimate the shipping costs, the app has to request some information from the user. The user should provide their location and the destination country. This will allow the app to calculate a range of shipping costs that are possible for this shipment.

A connection to a courier’s tracking system allows you to monitor what has been dispatched and more accurately forecast arrival timeframes, allowing you to provide better service to your clients. It ensures that the products are delivered to the customers on time, and it is also a way for customers to track their packages.

If you need to send a product straight from a supplier or manufacturer to a client, it might mess up your invoicing unless your accounting software can handle drop shipments.

Regular monitoring of attendance and hours is critical for correct payroll whether you pay employees by the hour or require them to check in at a specific time. A timeclock is typically used to guarantee precise timekeeping. These time clocks can accept electronic swipe cards, barcodes, PINs, or even biometrics, and some platforms allow users to clock in using a web browser or an app. There are many apps that offer a time tracking feature. But what is the use of it? It helps the employer to know how much time the employees are spending on their work. It also helps them to monitor the productivity and efficiency of their staff. Some apps allow employees to input their hours into the app themselves, while others require supervisors to enter hours for them.

Businesses in service-based sectors frequently need to measure how long jobs take in order to charge the correct amount. This form of tracking can assist you in making future pricing changes and identifying trends in the expenses of various jobs. The job tracking feature in the accounting app enables you to keep track of all your jobs and expenses. It helps you to calculate the time spent on a particular task, so that you can determine the cost of the job, which is crucial for all freelancers. The app provides a great way to manage your projects and tasks in one place. You can also use this app if you are not an accountant but have clients who need their financials done on time.

You can keep track of what has to be done and when your software displays you which jobs are active and which are dormant. It allows users to see what tasks they need to complete and how much money they will have after completing them. This feature is not just limited to businesses, it also helps freelancers with their tax returns so they know how much money they will be getting back on their taxes.

Tracking inventory is a tedious task that requires a lot of time and effort. This is where accounting software can help you a lot by providing an inventory tracking feature. It allows you to easily keep track of your inventory in real time and also create reports on your business performance with just one click. Following an item’s lifespan – from purchase to stocking to sales, all the way to shipment – is a terrific asset for tracking inventory levels.

You may avoid over or under buying specific goods by utilizing automated ordering to assure supply within a given range. This spares you the trouble of not having things in stock when you really need them or having a surplus of products that just won’t sell. is an automated process that helps to create a better inventory flow. It enables the user to set the inventory levels for different items and have them automatically replenished when they run out.

The presence of item photos is also beneficial for distributors since it helps all parties involved in the process to visually identify products and guarantee that the proper things are supplied. Not only are customer reviews an important factor for determining the quality of a product, but the presence of item photos is also beneficial for distributors since it helps all parties involved in the process to visually identify products and guarantee that the proper things are supplied.

For big distribution hubs, including stock locations on orders eliminates the need for a separate warehouse management system, which helps to simplify company activities. This feature helps you specify the stock locations where you want to track your inventory. One can also use it to exclude specific locations from tracking.

For certain service companies, presenting an estimate is critical to securing the contract – and maybe being paid. A system that can save estimates and convert them into sales and invoices in a matter of seconds enhances efficiency. To see how this works, let’s take an example. Let’s say you are running a small shop that sells books and coffee. You have started your own business, so you know that there will be some costs associated with starting up, but you also know that you will make money from your sales over time. The estimates feature in your accounting app allows you to project what your profits and losses will be for the next few months based on average sales figures.

Buying material for a new project and paying the bill for a client lunch? Take a photo of the receipt and the software app will record the vendor, tallies and taxes for you. Yes, expenditure monitoring has just gotten a whole lot easier.

These accounting applications sync between the desktop and mobile accounting apps, allowing you to work on any platform you want without losing any crucial information. With this feature, they can get all their data synced without having to manually enter the same information again. This feature can be used by accountants to automate the process of entering data from one system to another. It also helps them avoid errors since they have to enter less information this way.

● Zoho Books is a good choice for companies that demand more than simply accounting software. This tool helps you to concentrate on your daily tasks without having to worry about procedures such as bookkeeping, time tracking, and overall organization. Zoho Books also features an integrated customer interface that allows users to track transactions and organize bank data based on their preferences.

● If you’re searching for a free alternative to more expensive accounting programmes like QuickBooks and FreshBooks, consider Wave Accounting – you’ll receive a cost-effective invoicing and accounting system that supports card processing and payroll processing.

● Wave is an excellent accounting software application for a service-based small firm that delivers basic invoices but does not require payroll processing. Wave’s free features will fulfill all of the accounting needs of many freelancers and the service-based enterprises, making it the best free software in our evaluation. Accountants can use Wave software to pull the reports they need to compile a company’s tax return at the end of the year. Overall, the software is a useful tool for small enterprises.

● Wave Accounting’s finest feature is that it automatically manages all client payments – the system makes it possible to connect bank accounts with credit cards, as well as receive and process payments from any credit cards.

● Sage Accounting is an accounting and business software designed mostly for small enterprises; you’ll be able to manage payments and expenses, establish automated reminders for payments and other vital information, generate reports, and track statistics.

● ZipBooks is a free accounting and web – based invoicing software with a broader set of capabilities that will help you streamline more than just your accounting activities – you’ll also receive insight into the operations of your business. The ZipBooks accounting tool’s distinguishing feature is its Intelligence system, which provides insights and analyses that highlight your successful clients and demonstrate how you compare to the competition.

● Expensify is a small business accounting solution that allows you to track your receipts and conveniently submit business costs for reimbursement and approval. Expensify also syncs with most major accounting software, allowing you to efficiently increase the app’s functionality.

● Wagepoint is online payroll software designed to assist your small or medium-sized business in paying employees and contractors while remaining in compliance with federal tax laws.

● Tally is without a doubt the most well-known and commonly used accounting software in India for more than two decades. Tally has evolved from its MS-DOS-based beginnings to become a full-fledged ERP software in its own right. Tally ERP 9 is the most recent version, and it comes with VAT reporting from all of India’s states. The single-user version costs Rs. 21,000, while the multi-user version costs Rs. 62,000, which is rather pricey, plus Rs. 4,000 each year for upgrades. You may also utilize the remote desktop version, which allows you to access tally from a remote place, but your server must be turned on at all times. Because it is so expensive, it is also the most pirated programme in India. However, a large number of users of the pirated version complain of data corruption, mismatching, and data loss. We strongly advise you to only use the licenced version of Tally.

● The inventory aspects of Busy are well-known. It offers three software versions: basic, standard, and enterprise. The prices, exclusive of taxes, for the aforementioned models are Rs. 7,200, Rs. 13,500, and Rs. 19,800, respectively. The firm claims to have over 6,00,000 customers.

● MargERP 9+ is an inventory and accounting software in India that supports GST billing and filing. Generate batch invoices, obtain full information on a company transaction, use auto bank reconciliation, encode and centralize barcodes, and submit GST transactions through the portal. MargERP 9+ aids in the selection of the appropriate GST slab and the segregation of transactions accordingly. The programme guides and automates SGST, CGST, and IGST computations. MargERP9+ is a trade-specific solution that is both inexpensive and adaptable in terms of functionality. The programme is simple to deploy and allows you to construct functionality for business assistance with over 2500 software configurations and 500 training videos.

The monthly cost of small company accounting software ranges from $0 to $150. Basic plans vary from $0 to $40 per month and are an excellent place to start. A simple plan will let a small firm organize income and costs, send invoices, and produce financial reports. Most software is scalable, and the plan may be quickly changed to suit new business demands as the company expands. The more powerful plans enable firms to monitor inventory, create more personalized financial reports, conduct payroll, and select from a wider range of invoicing alternatives.

If you are considering constructing an app, you must first consider a platform. Create an iOS or Android app. The cost of any platform will vary depending on the time and quantity of work required. It will also be less expensive if you only design an app for one platform. In brief, the cost of development is primarily determined by the platform used to construct the app, whether it be iOS, Android, or both. The price will vary depending on the platform you use.

There are two main development teams. There are two development teams: front-end and back-end. And the complete team is made up of Project Managers, Quality Testers, Designers, and so on. They all have an impact on the project cost, such as the framework utilized, hosting, and language chosen, which all have various price tags. The cost of each stage of app development is listed below. Backend: $22,800–$40,800; Frontend (mobile apps): $20,800–$32,400; Content and exercises: $32,000–$52,000. The location of the App Development team also has an impact on the development cost. The cost of producing the app in India differs from that of the United States and other nations.

Accounting apps are perfect for small businesses that need a simple way to manage their finances without having to purchase expensive software programs. Accounting apps are a great way to keep track of your financial performance. They are accessible on any device, so you can access them at any time. The apps also come with helpful features like automatic reminders, receipts, and invoices. Looking for a team who can help you with the development of an Accounting software? We will provide you with some of the best Accounting software and apps within your budget and your firm can utilize those accordingly.

You can trust our software development company, Poulima Infotech for all your accounting software development needs. Contact us here now to know more about our accounting software development services. From web-based accounting services to mobile based accounting application development services, we have all for you.

Something isn’t Clear?

Feel free to contact Us, and we will be more than happy to answer all of your questions.